-

![[image]](https://www.balancer.ru/cache/sites/org/ha/habrastorage/habr/post_images/8e1/5ee/93d/128x128-crop/8e15ee93d757cb0f8ebc53eedc750579.jpg)

Частная и коммерческая космонавтика

Теги:

Новость промелькнула - частная китайская компания провела (27 марта вроде бы) испытания своей космической ракеты. Неудачно - вскоре после взлёта потеря управления/стабилизации. В общем ракета вилять начала как ненормальная.

Видео очень красивое получилось. Надо поискать ссылки, должны же быть.

Видео очень красивое получилось. Надо поискать ссылки, должны же быть.

ED> Видео очень красивое получилось. Надо поискать ссылки, должны же быть.

но это все сторонние, на канале компании ничего нет. Наверное, все в китайском интернете

но это все сторонние, на канале компании ничего нет. Наверное, все в китайском интернете

s.t.> https://www.youtube.com/watch?v=cFml9UKO1SI

У меня не показывает.

А что за компания и что за ракета?

OneSpace OS-M?

ЗЫ. Если OneSpace, то вроде не испытания даже, а первый их коммерческий запуск гикнулся. Полезная нагрузка - спутник Lingque 1B.

У меня не показывает.

А что за компания и что за ракета?

OneSpace OS-M?

ЗЫ. Если OneSpace, то вроде не испытания даже, а первый их коммерческий запуск гикнулся. Полезная нагрузка - спутник Lingque 1B.

Не откажу себе (цельнотянуто с АШ) в:

И тут Руслан Карманов не сдержалсИ

А вот КАК именно действует Свободный Открытый Честный Рыночек в космосе на самом деле:

«Доминирующие позиции США в космосе быстро убывают благодаря технологическим успехам Китая и России. Об этом в опубликованном в The Wall Street Journal материале пишет исполняющий обязанности министра обороны США Патрик Шанахан.

Он также напомнил, что в минувшем году США запустили в космос 17 ракет, тогда как Китай – 38. За последние 50 лет американцы ни разу не высаживались на Луне, а КНР 3 января успешно приземлила на обратной стороне естественного спутника Земли космический аппарат «Чанъэ-4».

И тут Руслан Карманов не сдержалсИ

«Что-то непонятно ничего. Ведь от США все отстали на 50-100 лет, да в США уникальный Свободный Открытый Честный Рыночек, на него выбегают огромные полчища Прорывных Космических Стартапов и давай конкурировать, непрерывно изобретая прорывные технологии (около 100 миллионов тайных технологий уже изобретено) и снижая стоимость запусков и за-киллограмм-до-орбиты. Разве нет? Всем им выданы чемоданы льгот, дотаций, они осваивают деньги инвесторов и вот-вот прорывы. Вот-вот».

А вот КАК именно действует Свободный Открытый Честный Рыночек в космосе на самом деле:

Мошенничество в NASA: две неудачные миссии и убытки в $700 млн

Расследование NASA и Минюста США показало, что подрядчик агентства 19 лет поставлял некачественный алюминий для ракет // tech.liga.net«Расследование NASA и Минюста США показало, что подрядчик агентства 19 лет поставлял некачественный алюминий для ракет.

Было обнаружено, что обтекатели на ракетах не смогли отделиться из-за разрушения алюминиевых профилей в месте соединения шарниров. Согласно данным Министерства юстиции США, результаты испытаний материала в период с 1996 по 2015 годы признаны таковыми, которые не соответствуют действительности».

Wyvern-2>> А вот КАК именно действует Свободный Открытый Честный Рыночек в космосе на самом деле:

Дем> Это госзакупки, однако.

Ага -у частной компании. Накал попила, размеры отката и чернота коррупции всегда больше на стыках частного и государственного

Просто пытаюсь донести свою весьма незамысловатую мыслю: освоение космоса пока (пока!) настолько сложный кейс (тьфу, блин, Вахштайна наслушался ), что частному капиталу он НЕ по плечу - зато отличный повод попилить, откатить и мздоимствовать не просто так, а с "выдумкой и энтузиазмом" © Шукшин ...

), что частному капиталу он НЕ по плечу - зато отличный повод попилить, откатить и мздоимствовать не просто так, а с "выдумкой и энтузиазмом" © Шукшин ...

Дем> Это госзакупки, однако.

Ага -у частной компании. Накал попила, размеры отката и чернота коррупции всегда больше на стыках частного и государственного

Просто пытаюсь донести свою весьма незамысловатую мыслю: освоение космоса пока (пока!) настолько сложный кейс (тьфу, блин, Вахштайна наслушался

), что частному капиталу он НЕ по плечу - зато отличный повод попилить, откатить и мздоимствовать не просто так, а с "выдумкой и энтузиазмом" © Шукшин ...

), что частному капиталу он НЕ по плечу - зато отличный повод попилить, откатить и мздоимствовать не просто так, а с "выдумкой и энтузиазмом" © Шукшин ...

Российская частная компания планирует создать группировку спутников для интернета вещей

Радиомодуль, который будет использоваться для обеспечения связи, проходит тестирование на спутнике "Норби", запущенном 28 сентября с космодрома Плесецк // tass.ruОКБ "Пятое поколение" (резидент Сколково и новосибирского Академпарка) планирует запустить группировку малых аппаратов для интернета вещей. Об этом сообщили ТАСС в пресс-службе конструкторского бюро.

"В планах на будущее - запуск группировки малых аппаратов для организации связи в сегменте М2М (machine-to-machine)", - отметили в ОКБ, не уточнив сроки создания группировки.

Сейчас радиомодуль, который будет использоваться для обеспечения связи, проходит тестирование на спутнике "Норби", запущенном 28 сентября с космодрома Плесецк. Аппарат находится на орбите, все сеансы связи с ним идут в штатном режиме. "Норби" не будет являться частью группировки, он был запущен для летных испытаний платформы и отработки работоспособности в реальных условиях.

ОКБ "Пятое поколение" занимается проектированием малых космических аппаратов и бортовой спутниковой аппаратуры. Один из самых крупных проектов конструкторского бюро - разработка собственной модульной спутниковой платформы формата CubeSat с набором всех необходимых подсистем. Работа ведется совместно с Новосибирским государственным университетом и Отделом аэрокосмических исследований (ОАИ НГУ).

Vector Launch возобновит деятельность

Прошедшая через процедуру банкротства компания Vector Launch возобновит работы по созданию ракет // universemagazine.comПредприятие TLS Bidco, выкупившее ракетные активы Vector Launch, объявило о намерении возобновить работу по созданию малого носителя. Новые владельцы планируют внести в проект ряд изменений. Изначально в качестве топлива Vector-R планировалось использовать пару «пропилен-кислород». Теперь же предпочтение будет отдано традиционной паре «керосин-кислород». Также поменяется система наддува баков гелием, а композитные баки заменят на алюминиевые. Новые компоненты будут интегрированы в уже имеющуюся конструкцию ракеты.

Также новое руководство решило сменить общие приоритеты деятельности компании. На первой стадии основной упор будет сделан на суборбитальные полеты. В случае успеха Vector Launch сможет занять часть рынка геофизических ракет. После этого предприятие вернется к созданию носителя, способного выводить грузы на орбиту. Что касается примерных сроков, то первый после банкротства суборбитальный запуск должен состояться в течение 12-15 месяцев.

matvey> "Предприятие TLS Bidco, выкупившее ракетные активы Vector Launch, объявило о намерении возобновить работу по созданию малого носителя. ...

matvey> Также новое руководство решило сменить общие приоритеты деятельности компании. На первой стадии основной упор будет сделан на суборбитальные полеты. ..."

Ничего у них не выйдет. Рынок суборбитальных пусков маленький и не развивается. Даже SpaceLoft и EXOS провалились.

А Кантрел уже в 2019-м образовал новую фирму.

matvey> Также новое руководство решило сменить общие приоритеты деятельности компании. На первой стадии основной упор будет сделан на суборбитальные полеты. ..."

Ничего у них не выйдет. Рынок суборбитальных пусков маленький и не развивается. Даже SpaceLoft и EXOS провалились.

А Кантрел уже в 2019-м образовал новую фирму.

Aevum показал беспилотник для космических запусков

Аэрокосмический стартап Aevum показал беспилотник Ravn X, предназначенный для запуска малых ракет // universemagazine.comДлина Ravn X составляет 24,4 м, размах крыльев — 18,3 м, высота — 5,5 м, максимальная взлетная масса — 24,9 тонны. Его полезной нагрузкой станет двухступенчатая ракета собственного производства Aevum, способная вывести на НОО до 500 кг полезной нагрузки. Остальные детали системы (в том числе и летные характеристики Ravn X) пока держатся в секрете.

По замыслу создателей, Ravn X должен стать полностью автономной системой. Дрон работает на обычном авиационном топливе, он сможет взлетать и садиться на обычную взлетно-посадочную полосу протяженностью в 1,6 км. Это значит, что в теории его можно будет запускать практически с любого действующего аэродрома. А поскольку аппарат не имеет пилота, его обслуживание, подготовка и осуществление запуска также существенно упростятся. Ранее представители Aevum заявляли, что для этого потребуется команда, состоящая лишь из шести человек, а Ravn X сможет осуществлять миссии с интервалом всего в три часа.

Уже в ближайшее время Aevum планирует начать интенсивные летные испытания беспилотника. Его первый запуск надеются осуществить еще до конца 2021 г. Стоит отметить, что у компании уже имеет пусковой контракт на сумму 4,9 млн долларов, предусматривающий вывод на орбиту спутника ASLON-45 для Космических сил США.

По материалам:

Ars Technica

Serving the Technologist for more than a decade. IT news, reviews, and analysis. // arstechnica.com

энди> Корешки хотят испытать двигатель на воде (паровой) в космосе. В декабре должен быть запуск, перенесли на январь.

Корешки, случайно, не у Кокорича в Моментусе работают? Их VR-1 как раз летят на Transporter 1 и ин передвинули с декабря на январь (Не Ранее Чем), ну и как понятно у них главный двигатель плазменно-водяной.

Дополнительную пикантность ситуации придаёт то, что на VR-1 с водяным двигателем летит SteamJet-1 с водяным двигателем. Так что корешки могут быть и там. И даже скорее всего, так как люди Кокорича свой двигатель уже испытали на спутнике El Camino Real.

Вот тут хорошая раскадровка:

Корешки, случайно, не у Кокорича в Моментусе работают? Их VR-1 как раз летят на Transporter 1 и ин передвинули с декабря на январь (Не Ранее Чем), ну и как понятно у них главный двигатель плазменно-водяной.

Дополнительную пикантность ситуации придаёт то, что на VR-1 с водяным двигателем летит SteamJet-1 с водяным двигателем. Так что корешки могут быть и там. И даже скорее всего, так как люди Кокорича свой двигатель уже испытали на спутнике El Camino Real.

Вот тут хорошая раскадровка:

Smallsat Rideshare Missions – ElonX.net

Unofficial list of planned SpaceX Smallsat Rideshare missions and their known payloads. – SpaceX // www.elonx.net

Fakir> А они именно частники, или из НИИ?

Fakir> Продавать думают, есть спрос, если получится?

А почему бы не всё сразу?

Особенно красив Фёдоров - как с паспорта фото. Сразу видно, что наш человек. Захаров с Тимофеевым тоже ничего - молодые, а уже ко-фаундеры. А ещё говорят, что в индустрии кадров нет.

Fakir> Продавать думают, есть спрос, если получится?

А почему бы не всё сразу?

SteamJet Space Systems – Water fueled thruster for satellite orbit control

Datasheet request Datasheet request Datasheet request We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Ok We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Ok // steamjet.spaceОсобенно красив Фёдоров - как с паспорта фото. Сразу видно, что наш человек. Захаров с Тимофеевым тоже ничего - молодые, а уже ко-фаундеры. А ещё говорят, что в индустрии кадров нет.

zaitcev> Корешки, случайно, не у Кокорича в Моментусе работают?

На бегу все было ,пока всем косточки перемыли(а это главное,сам понимаш) на космос время не осталось)))) да думаю как то там все вместе .Контора американская для удобства(может и часть денег оттуда) но проектировали и испытывали вроде у нас .По какому то гранту НГУ купили нормальные вибростенды и испытательное оборудование которые бОльшей частью простаивают -арендуют ,испытывают.

Оне да . с Пашей Савиным вместе картоху давили в колхозе а Витей Агафоновым были в одной группе (но в разных)подгруппах

На бегу все было ,пока всем косточки перемыли(а это главное,сам понимаш) на космос время не осталось)))) да думаю как то там все вместе .Контора американская для удобства(может и часть денег оттуда) но проектировали и испытывали вроде у нас .По какому то гранту НГУ купили нормальные вибростенды и испытательное оборудование которые бОльшей частью простаивают -арендуют ,испытывают.

Оне да . с Пашей Савиным вместе картоху давили в колхозе а Витей Агафоновым были в одной группе (но в разных)подгруппах

Это сообщение редактировалось 21.12.2020 в 07:36

Интересующимся в качестве ликбеза по теме, для понимания базовых принципов и некоторых опорных фактов, можно порекомендовать книжку:

Gurtuna, Fundamentals of Space Business and Economics, 2013

Книжка небольшая, всего 100 стр., не бог весть что, вещи по большей части описаны довольно очевидные.

Прямо скажем, при таком пафосном введение и заведении с претензией на глубокую профессиональность можно было бы и получше написать. Впрочем, кажется, заведение какое-то самопальное, не под эгидой ЕКА, и его взаимоотношения с космическими агентствами непонятны - ну да не суть, повторюсь, в качестве ликбеза норм.

Несмотря на то, что вещи по большей части описаны довольно очевидные, как показывает форумная (и не только) практика, многие очевидные и даже тривиальные вещи очевидны далеко не всем. Бывают какие-то барьеры понимания или недостаток опыта понимания в некоторых областях. А у Гуртуны всё в одну кучку собрано, так что для затравки сгодится.

Экстрактно, ключевые тезисы (хотя ряд из них и не стоит внимания):

Top Ten Things to Know About Space Business and Economics

1. Cost is not equal to price. The space industry is moving towards fixed-price

contracts and established companies need to adapt to this new market reality.

Increasingly, products and services will be priced based on the value they offer

to customers, regardless of how much they cost to build.

2. Space professionals need to better “market” space activities. They need to

develop a more effective marketing mix and communicate the benefits of their

projects clearly.

3. Government is still the biggest customer. As the industry matures, private sector

is steadily increasing its clout. Companies such as SpaceX have proven that

they can provide access to LEO. But it remains to be seen if this will result in

any actual cost savings. Other projects such as Orbital Science’s Antares/Cynus

and Stratolaunch Systems must prove their viability to convert isolated successes

into a true historic trend.

4. When it comes to risk and space, perhaps the greatest risk we are facing is not to

invest in space-based capabilities at all. Without understanding planetary evolution

by studying our planetary neighbors we may never fully grasp the reasons

and consequences of climate change. Without keeping a close eye on NEOs, we

can never be sure that Earth is safe from an imminent collision. Therefore, risk

of inaction will always be more than the risk of space exploration.

5. A private space venture still needs to work with the government. As long as the

government assumes the role of an anchor tenant or loyal customer, it is possible

to generate revenues in the early years. This is clearly illustrated by the

multi- billion dollar contracts that NASA has with SpaceX and Orbital Science

to resupply the International Space Station.

6. We are moving from a global to a “planetary” economy. In the long-run, it is

possible that there will be demand and supply centers in various points of our

Solar System. If, one day, there are human settlements on the Moon, Mars,

and other planetary bodies, the destination problem will be completely solved

and access to space will be a necessity. In the short term, the viability of

point-to-point suborbital transportation on Earth will be a true test of a sustainable

and profi table market for human spaceflight.

7. Portfolio diversification works quite well for the private sector, with its expertise

in replicating many “missions” and managing fi nancial risk through launch

insurance and other means. However, the catastrophic risk of losing lives seriously

limits the use of portfolio-based methods for human spaceflight.

8. Some of the challenges outlined in this book can actually be great business

opportunities. For example, space ventures aimed at solving the space debris

risks can be very interesting for governmental and private sector customers.

9. Conventional financing methods such as venture capital and private equity are

generally not applicable to space ventures. Thus, identifying and implementing

innovative ways of fi nancing is critical for the success of a space venture.

10. It’s not all about business. What we learn through space activities can be exactly

what we need to benefit from the vast natural resources of the universe and

further expand our civilization. Space can help us enormously in understanding

Earth as a “system of systems” and developing its resources in a sustainable

manner.

Gurtuna, Fundamentals of Space Business and Economics, 2013

This Springer book is published in collaboration with the International Space

University. At its central campus in Strasbourg, France, and at various locations

around the world, the ISU provides graduate-level training to the future leaders of

the global space community. The university offers a 2-month Space Studies

Program, a 5-week Southern Hemisphere Program, a 1-year Executive MBA and a

1-year Masters program related to space science, space engineering, systems engineering,

space policy and law, business and management, and space and society.

This book is written with two main audiences in mind. First and foremost, it is for

space professionals who are interested in better understanding the core economics

and business concepts applicable to space. Second, it is also for readers who have a

business or economics background and a general interest in space.

Книжка небольшая, всего 100 стр., не бог весть что, вещи по большей части описаны довольно очевидные.

Прямо скажем, при таком пафосном введение и заведении с претензией на глубокую профессиональность можно было бы и получше написать. Впрочем, кажется, заведение какое-то самопальное, не под эгидой ЕКА, и его взаимоотношения с космическими агентствами непонятны - ну да не суть, повторюсь, в качестве ликбеза норм.

Несмотря на то, что вещи по большей части описаны довольно очевидные, как показывает форумная (и не только) практика, многие очевидные и даже тривиальные вещи очевидны далеко не всем. Бывают какие-то барьеры понимания или недостаток опыта понимания в некоторых областях. А у Гуртуны всё в одну кучку собрано, так что для затравки сгодится.

Экстрактно, ключевые тезисы (хотя ряд из них и не стоит внимания):

Top Ten Things to Know About Space Business and Economics

1. Cost is not equal to price. The space industry is moving towards fixed-price

contracts and established companies need to adapt to this new market reality.

Increasingly, products and services will be priced based on the value they offer

to customers, regardless of how much they cost to build.

2. Space professionals need to better “market” space activities. They need to

develop a more effective marketing mix and communicate the benefits of their

projects clearly.

3. Government is still the biggest customer. As the industry matures, private sector

is steadily increasing its clout. Companies such as SpaceX have proven that

they can provide access to LEO. But it remains to be seen if this will result in

any actual cost savings. Other projects such as Orbital Science’s Antares/Cynus

and Stratolaunch Systems must prove their viability to convert isolated successes

into a true historic trend.

4. When it comes to risk and space, perhaps the greatest risk we are facing is not to

invest in space-based capabilities at all. Without understanding planetary evolution

by studying our planetary neighbors we may never fully grasp the reasons

and consequences of climate change. Without keeping a close eye on NEOs, we

can never be sure that Earth is safe from an imminent collision. Therefore, risk

of inaction will always be more than the risk of space exploration.

5. A private space venture still needs to work with the government. As long as the

government assumes the role of an anchor tenant or loyal customer, it is possible

to generate revenues in the early years. This is clearly illustrated by the

multi- billion dollar contracts that NASA has with SpaceX and Orbital Science

to resupply the International Space Station.

6. We are moving from a global to a “planetary” economy. In the long-run, it is

possible that there will be demand and supply centers in various points of our

Solar System. If, one day, there are human settlements on the Moon, Mars,

and other planetary bodies, the destination problem will be completely solved

and access to space will be a necessity. In the short term, the viability of

point-to-point suborbital transportation on Earth will be a true test of a sustainable

and profi table market for human spaceflight.

7. Portfolio diversification works quite well for the private sector, with its expertise

in replicating many “missions” and managing fi nancial risk through launch

insurance and other means. However, the catastrophic risk of losing lives seriously

limits the use of portfolio-based methods for human spaceflight.

8. Some of the challenges outlined in this book can actually be great business

opportunities. For example, space ventures aimed at solving the space debris

risks can be very interesting for governmental and private sector customers.

9. Conventional financing methods such as venture capital and private equity are

generally not applicable to space ventures. Thus, identifying and implementing

innovative ways of fi nancing is critical for the success of a space venture.

10. It’s not all about business. What we learn through space activities can be exactly

what we need to benefit from the vast natural resources of the universe and

further expand our civilization. Space can help us enormously in understanding

Earth as a “system of systems” and developing its resources in a sustainable

manner.

Это сообщение редактировалось 28.06.2022 в 18:45

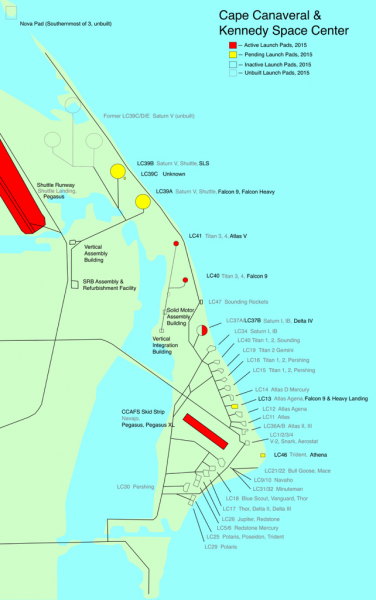

Неделю назад прошла новость по поводу продолжаюшцйся раздачи площадок "ракетного ряда". В дополнение к пл.16, с которой сегодня состоялся неудачный пуск Террана, объявлено вот что:

ABL получает пл.15

Стоук получает пл.14

Фантом и Вайя делят пл.13 - не знаю с забором посредине или будут накатывать на одно сооружение поочередно. Поскольку на территории LC-13 уже находятся посадочные площадки Спейсов, то скорее всего они займут оставшиеся углы квадрата. Но я не знаю, может быть что угодно.

P.S. Чтоб два раза не вставать:

37 - Дельта 4

34 - музейная площадка (я там был, ничего не осталось кроме рассекателя)

20 - Файрфлай

19 - не используется

16, 15, 14, 13 - см. выше

11 - стенд для двигателей Блю

12 - не используется

36 - Блю, Нью Шепард

46 - Астра

Ну реально настоящий космодром получается. Больше ракет хороших и разных!

ABL получает пл.15

Стоук получает пл.14

Фантом и Вайя делят пл.13 - не знаю с забором посредине или будут накатывать на одно сооружение поочередно. Поскольку на территории LC-13 уже находятся посадочные площадки Спейсов, то скорее всего они займут оставшиеся углы квадрата. Но я не знаю, может быть что угодно.

P.S. Чтоб два раза не вставать:

37 - Дельта 4

34 - музейная площадка (я там был, ничего не осталось кроме рассекателя)

20 - Файрфлай

19 - не используется

16, 15, 14, 13 - см. выше

11 - стенд для двигателей Блю

12 - не используется

36 - Блю, Нью Шепард

46 - Астра

Ну реально настоящий космодром получается. Больше ракет хороших и разных!

Прикреплённые файлы:

Это сообщение редактировалось 23.03.2023 в 08:15

zaitcev> Стоук получает пл.14

Между прочим, работа кипит:

Между прочим, работа кипит:

Full Reusability By Stoke Space

Tim Dodd, the Everyday Astronaut, interviewed Andy Lapsa about Stoke Space, and its approach of starting with 100% reusability. // everydayastronaut.com

zaitcev> Между тем, внезапно... Каг горох из мешка посыпались коммерческие станции.

Пять лет прошло... Давайте посмотрим.

zaitcev> Биглоу всё ещё с нами, и организовал какую-то новую фирму для эксплуатации B330.

Тут всё глухо.

zaitcev> Далее, свежачок: Аксиом (Axiom Space) тоже работает над своим модулем.

Аксиом ничего не запустил, только продолжают обещать. Зато вот такой поворот: они теперь организуют полёты на МКС на Драгоне. В общем эта фирма явно существует, чтобы выжимать соки из центра им Джонсона в Хьюстоне.

zaitcev> И наконец, есть какой-то мутный проект "Orion Span", о котором я никогда не слышал. По-видимому, энтузиасты без нифига, но пытаются найти финансирование ...

Так и получилось.

Но теперь в добавок к неубиваемым попильщикам Аксиома появился целый ворох претендентов.

Самый традиционный из них - Vast - обещает одномодульную станцию традиционной архитектуры. Никакой изюминки я не вижу.

Кроме того, NASA решило сотрудничать с набором изготовителей автономных, посещаемых и автоматических станций. Среди получателей поддержки Нортроп, СпейсЭкс, Сьерра.

Пять лет прошло... Давайте посмотрим.

zaitcev> Биглоу всё ещё с нами, и организовал какую-то новую фирму для эксплуатации B330.

Тут всё глухо.

zaitcev> Далее, свежачок: Аксиом (Axiom Space) тоже работает над своим модулем.

Аксиом ничего не запустил, только продолжают обещать. Зато вот такой поворот: они теперь организуют полёты на МКС на Драгоне. В общем эта фирма явно существует, чтобы выжимать соки из центра им Джонсона в Хьюстоне.

zaitcev> И наконец, есть какой-то мутный проект "Orion Span", о котором я никогда не слышал. По-видимому, энтузиасты без нифига, но пытаются найти финансирование ...

Так и получилось.

Но теперь в добавок к неубиваемым попильщикам Аксиома появился целый ворох претендентов.

Самый традиционный из них - Vast - обещает одномодульную станцию традиционной архитектуры. Никакой изюминки я не вижу.

VAST — Live in Space

Vast is developing space stations to expand humanity across the solar system // www.vastspace.comКроме того, NASA решило сотрудничать с набором изготовителей автономных, посещаемых и автоматических станций. Среди получателей поддержки Нортроп, СпейсЭкс, Сьерра.

NASA picks 7 companies to advance commercial space capabilities - SpaceFlight Insider

NASA has partnered with seven companies to help advance space capabilities to meet the agency’s needs while building up a commercial low orbit economy. // www.spaceflightinsider.com

Virgin Galactic впервые свозила туристов к границе космоса. Фильмец на 55 минут:

Copyright © Balancer 1997..2025

Создано 10.01.2014

Связь с владельцами и администрацией сайта: anonisimov@gmail.com, rwasp1957@yandex.ru и admin@balancer.ru.

Создано 10.01.2014

Связь с владельцами и администрацией сайта: anonisimov@gmail.com, rwasp1957@yandex.ru и admin@balancer.ru.

ED

ED

инфо

инфо инструменты

инструменты

Wyvern-2

Wyvern-2

aspid_h

aspid_h

zaitcev

zaitcev

Fakir

Fakir

Fakir

Fakir